Saturday, October 11, 2014

Byron W. Ellis

I have found that the No. 1 concern of most retirees is potential healthcare costs. I also have experienced that most retirees tend to avoid making a decision on how to prepare for potential long-term care costs.

When you think about long-term care, what is the first thing that comes to mind? For many, it may be nursing homes or something associated with aging and increasing medical needs. In a broad sense, this is appropriate, but much has changed in the last decade or two in regard to long-term care options and how to fund them.

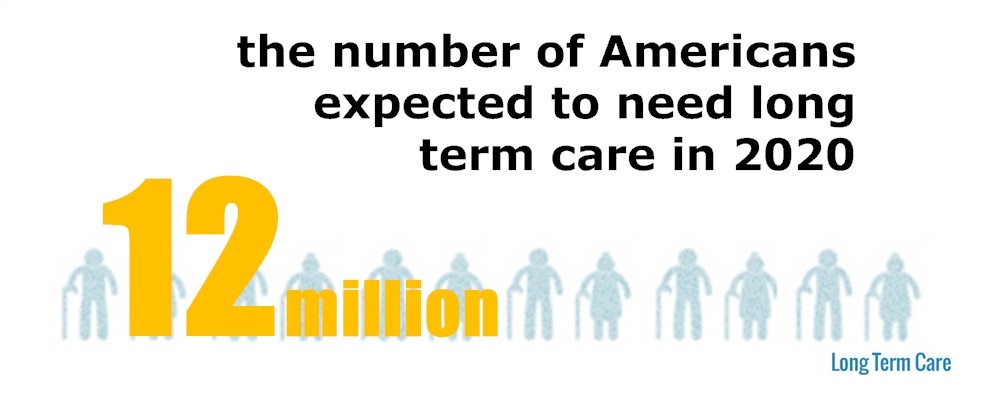

Boomers (and the next generation of retirees) need to plan for long-term care in a different way than their parents as they’re facing the unclear future of entitlement benefits and rapidly rising medical costs. And they’re living longer. When it comes to long-term care planning, many people have the “it won’t happen to me” attitude; however, approximately 70 percent of people over age 65 will need some sort of long-term care assistance during retirement.

Evolving long-term care options

The difficult question that weighs on many people is how do you plan for these unforeseen expenses so they don’t derail retirement? When planning for long-term care costs, you have options such as earmarking savings for medical expenses or relying on entitlement benefits or family.

Long-term care insurance is another option for people to consider. Over the past several years, insurance products have evolved with care options and trends. Today, nearly half of benefits paid by private insurers are for in-home care or assisted-living care. Whereas before long-term care was primarily used to pay for skilled nursing care.** Many current policies also pay the benefit to the insured or insureds, unlike many policies in the past that paid a nursing facility directly. To understand more about the evolution of long-term care, here’s a deeper look at long-term care planning past and present:

Government programs: Those in the silent generation (those born during the Great Depression and World War II) were among the first to experience longer life spans, and the first to have access to official long-term nursing care facilities. However, the question of whether entitlements would be there was not a topic of conversation for this generation. As more boomers reach retirement age, the potential of a strain on government entitlement programs has become an increasing concern as current benefits may not cover most medical services a person with long-term care needs will face.

Long-term care insurance: With long-term care insurance being a relatively new idea, many parents of baby boomers likely didn’t consider the potential needs (and realistic costs associated) of formal long-term care. Since then, a number of options have been developed by insurers to meet boomer’s long-term care needs, and over time, long-term care insurance features have evolved. Some of them include:

Straight long-term care insurance policies: These are policies that pay a benefit up to the daily or monthly maximum. The amount can be paid to the insured person, who can then pay the care provider. The insured person also can choose to pay for the care provider to bill the insurance company directly.

Life insurance policies with a unique rider: Advanced benefit riders can be somewhat inexpensive additions to a life insurance policy, and they allow the death benefit (often up to 90 percent) to be paid in advance of death if the funds are needed for long-term care. Whatever amount is provided to the insured is simply deducted from the death benefit when that person passes away.

Policies that combine life insurance and long-term care insurance into one policy: Some insurance plan options may allow a lump sum premium to be paid for insurance that provides a combination of benefits such as a death benefit and the ability to advance most of that benefit for long-term care needs. These policies may even include a “right to rescind” the contract in which the policyholder may change his or her mind after a period of time and the full premium is refunded (if no benefit has been paid).

Family: Relying on family may seem like the simplest option, and it’s one that many people with long-term care needs choose, sometimes out of necessity. However, the emotional, physical and financial stress on family members caring for a dependent family member can be a very large undertaking. If you plan to rely on family members to support your long-term care needs, make sure to tell them well in advance so they can create a plan to address your needs and wishes.

An aging person who needs care may choose from many options to help provide or fund professional care including family, government resources, self-insurance (if there are enough assets) or private insurance. Each of these options has some merit, but in most cases, no single option on its own will cover everything. It’s difficult to predict what kind of long-term care needs you may need, which is why you may want to talk with a professional who can discuss the options for your unique situation.

Saturday, October 11, 2014

Byron W. Ellis, CFP, CLU, ChFC, CRPC, is a private wealth adviser and a Certified Financial Planner with Ellis & Ellis, a private wealth advisory practice of Ameriprise Financial Services.

Vasilios "Voss" Speros 602-531-5141

#LifeInsurance #RetirementStrategies #sperosfinancial

http://www.sperosfinancial.com/

https://www.linkedin.com/pub/vasilios-%22voss%22-speros/60/722/67b

vsperos@sperosfinancial.com

85254

Byron W. Ellis

I have found that the No. 1 concern of most retirees is potential healthcare costs. I also have experienced that most retirees tend to avoid making a decision on how to prepare for potential long-term care costs.

When you think about long-term care, what is the first thing that comes to mind? For many, it may be nursing homes or something associated with aging and increasing medical needs. In a broad sense, this is appropriate, but much has changed in the last decade or two in regard to long-term care options and how to fund them.

Boomers (and the next generation of retirees) need to plan for long-term care in a different way than their parents as they’re facing the unclear future of entitlement benefits and rapidly rising medical costs. And they’re living longer. When it comes to long-term care planning, many people have the “it won’t happen to me” attitude; however, approximately 70 percent of people over age 65 will need some sort of long-term care assistance during retirement.

Evolving long-term care options

The difficult question that weighs on many people is how do you plan for these unforeseen expenses so they don’t derail retirement? When planning for long-term care costs, you have options such as earmarking savings for medical expenses or relying on entitlement benefits or family.

Long-term care insurance is another option for people to consider. Over the past several years, insurance products have evolved with care options and trends. Today, nearly half of benefits paid by private insurers are for in-home care or assisted-living care. Whereas before long-term care was primarily used to pay for skilled nursing care.** Many current policies also pay the benefit to the insured or insureds, unlike many policies in the past that paid a nursing facility directly. To understand more about the evolution of long-term care, here’s a deeper look at long-term care planning past and present:

Government programs: Those in the silent generation (those born during the Great Depression and World War II) were among the first to experience longer life spans, and the first to have access to official long-term nursing care facilities. However, the question of whether entitlements would be there was not a topic of conversation for this generation. As more boomers reach retirement age, the potential of a strain on government entitlement programs has become an increasing concern as current benefits may not cover most medical services a person with long-term care needs will face.

Long-term care insurance: With long-term care insurance being a relatively new idea, many parents of baby boomers likely didn’t consider the potential needs (and realistic costs associated) of formal long-term care. Since then, a number of options have been developed by insurers to meet boomer’s long-term care needs, and over time, long-term care insurance features have evolved. Some of them include:

Straight long-term care insurance policies: These are policies that pay a benefit up to the daily or monthly maximum. The amount can be paid to the insured person, who can then pay the care provider. The insured person also can choose to pay for the care provider to bill the insurance company directly.

Life insurance policies with a unique rider: Advanced benefit riders can be somewhat inexpensive additions to a life insurance policy, and they allow the death benefit (often up to 90 percent) to be paid in advance of death if the funds are needed for long-term care. Whatever amount is provided to the insured is simply deducted from the death benefit when that person passes away.

Policies that combine life insurance and long-term care insurance into one policy: Some insurance plan options may allow a lump sum premium to be paid for insurance that provides a combination of benefits such as a death benefit and the ability to advance most of that benefit for long-term care needs. These policies may even include a “right to rescind” the contract in which the policyholder may change his or her mind after a period of time and the full premium is refunded (if no benefit has been paid).

Family: Relying on family may seem like the simplest option, and it’s one that many people with long-term care needs choose, sometimes out of necessity. However, the emotional, physical and financial stress on family members caring for a dependent family member can be a very large undertaking. If you plan to rely on family members to support your long-term care needs, make sure to tell them well in advance so they can create a plan to address your needs and wishes.

An aging person who needs care may choose from many options to help provide or fund professional care including family, government resources, self-insurance (if there are enough assets) or private insurance. Each of these options has some merit, but in most cases, no single option on its own will cover everything. It’s difficult to predict what kind of long-term care needs you may need, which is why you may want to talk with a professional who can discuss the options for your unique situation.

Saturday, October 11, 2014

Byron W. Ellis, CFP, CLU, ChFC, CRPC, is a private wealth adviser and a Certified Financial Planner with Ellis & Ellis, a private wealth advisory practice of Ameriprise Financial Services.

Vasilios "Voss" Speros 602-531-5141

#LifeInsurance #RetirementStrategies #sperosfinancial

http://www.sperosfinancial.com/

https://www.linkedin.com/pub/vasilios-%22voss%22-speros/60/722/67b

vsperos@sperosfinancial.com

85254

RSS Feed

RSS Feed