Speros Financial Life Insurance Tip of the day!

http://www.sperosfinancial.com/ 602-531-5141

Life insurance is an important part of your over all financial plan.

Some say it is a bad investment as well as you only need enough to pay the house off, since your spouse still works they will be fine, and that you only need it through your working years.

Protection part of life insurance through your working years

The reality is that life insurance is protection to your family in many ways. Yes you want to pay the house of if you die to soon, but you also made a deal with your family to always protect them and be there for them when they need you. Well after you die that is when they need you the most.

When I am talking to people about life insurance and they don't full understand it or appreciate what it can do for them. They tend to think there family will be just fine with the small amount they want to buy. But the people who have see death always want to buy as much as the life insurance company will allow them to buy.

Your family will not go back to work the next day and act like its no big deal. They will need time to morn, in most cases that could be months or even years to get back close to 100%.

The life insurance you buy today will be a replacement of your income to your spouse, the it will help with the bills of every day life. It will keep your kids in the home they grow up in, it will keep them in all the activities kids do. It will also send them to college and help start their lives as young adults. It will also give your spouse time to deal with everything death brings, such as the funeral expenses, any over due bills, the time it takes to switch everything into there name (always thinking about you as they take your name off things and breaking down to cry)

If you think about it, besides the cloths on your back and the food you eat, where does the rest of your money go? A portion to your retirement savings and the rest to the lifestyle you are accustomed to for you and your family. When your income stops coming in the portion to the retirement will stop, your spouse will have to figure that out on their own. The bills you pay for, well they might not get paid any more. The lifestyle your family is accustomed to- well that will have to change as well.

Protection in your retirement years

As you age your life insurance should age along side with you. You can't tell the future and you are not sure when your kids might need your help. They might move back in at some point. Or they have families of their own and you still want to make sure they will be ok after you die. So protection is always a key part.

Heres where the bad investment part plays in. If you are diversifying your retirement plan, you financial advisor will tell you to put part of your money in a safe accounts. Hmm what are bonds and CD's paying these days. Well the permanent life insurance (that people say is a bad investment) pays about 2 to 4 times what those do. It is a safe money or bond replacement account. And if you are diversifying your retirement why is everything in accounts tied to the market? Permanent life insurance through a mutual company is not tied to the market, so you don't have to worry about the ups and down of the market. It acts similar to the ROTH IRA grows tax differed and is tax free when you use you need it. Structured right you can put in more the 50x's what you can put into a ROTH IRA on an annual basis.

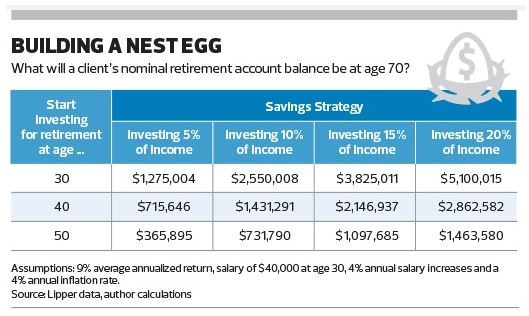

Also if you have an understanding of how income streams work in retirement, this will play a HUGE roll in your over all planning, and you might not need to save as much money as you thought.

There is a part that comes after retirement that most people tend to over look. That is the need for care, someone to take care of you when you can't do everything on your own. The benefits of Life insurance are pretty vast these days, But the only way you will know about these benefits is to take the time and learn about something that is not right in-front of you at this moment.

Death is not right in-front of you, your retirement is not right in-front of you and needing care is not right in-front of you. If any of those are then you will know the importance of proper planning and some will say I should have done more.

Don't be the person that says I should have done more, Just get it done now!

Vasilios "Voss" Speros 602-531-5141

#LifeInsurance #RetirementStrategies #sperosfinancial

http://www.sperosfinancial.com/

https://www.linkedin.com/pub/vasilios-%22voss%22-speros/60/722/67b

vsperos@sperosfinancial.com

85254

http://www.sperosfinancial.com/ 602-531-5141

Life insurance is an important part of your over all financial plan.

Some say it is a bad investment as well as you only need enough to pay the house off, since your spouse still works they will be fine, and that you only need it through your working years.

Protection part of life insurance through your working years

The reality is that life insurance is protection to your family in many ways. Yes you want to pay the house of if you die to soon, but you also made a deal with your family to always protect them and be there for them when they need you. Well after you die that is when they need you the most.

When I am talking to people about life insurance and they don't full understand it or appreciate what it can do for them. They tend to think there family will be just fine with the small amount they want to buy. But the people who have see death always want to buy as much as the life insurance company will allow them to buy.

Your family will not go back to work the next day and act like its no big deal. They will need time to morn, in most cases that could be months or even years to get back close to 100%.

The life insurance you buy today will be a replacement of your income to your spouse, the it will help with the bills of every day life. It will keep your kids in the home they grow up in, it will keep them in all the activities kids do. It will also send them to college and help start their lives as young adults. It will also give your spouse time to deal with everything death brings, such as the funeral expenses, any over due bills, the time it takes to switch everything into there name (always thinking about you as they take your name off things and breaking down to cry)

If you think about it, besides the cloths on your back and the food you eat, where does the rest of your money go? A portion to your retirement savings and the rest to the lifestyle you are accustomed to for you and your family. When your income stops coming in the portion to the retirement will stop, your spouse will have to figure that out on their own. The bills you pay for, well they might not get paid any more. The lifestyle your family is accustomed to- well that will have to change as well.

Protection in your retirement years

As you age your life insurance should age along side with you. You can't tell the future and you are not sure when your kids might need your help. They might move back in at some point. Or they have families of their own and you still want to make sure they will be ok after you die. So protection is always a key part.

Heres where the bad investment part plays in. If you are diversifying your retirement plan, you financial advisor will tell you to put part of your money in a safe accounts. Hmm what are bonds and CD's paying these days. Well the permanent life insurance (that people say is a bad investment) pays about 2 to 4 times what those do. It is a safe money or bond replacement account. And if you are diversifying your retirement why is everything in accounts tied to the market? Permanent life insurance through a mutual company is not tied to the market, so you don't have to worry about the ups and down of the market. It acts similar to the ROTH IRA grows tax differed and is tax free when you use you need it. Structured right you can put in more the 50x's what you can put into a ROTH IRA on an annual basis.

Also if you have an understanding of how income streams work in retirement, this will play a HUGE roll in your over all planning, and you might not need to save as much money as you thought.

There is a part that comes after retirement that most people tend to over look. That is the need for care, someone to take care of you when you can't do everything on your own. The benefits of Life insurance are pretty vast these days, But the only way you will know about these benefits is to take the time and learn about something that is not right in-front of you at this moment.

Death is not right in-front of you, your retirement is not right in-front of you and needing care is not right in-front of you. If any of those are then you will know the importance of proper planning and some will say I should have done more.

Don't be the person that says I should have done more, Just get it done now!

Vasilios "Voss" Speros 602-531-5141

#LifeInsurance #RetirementStrategies #sperosfinancial

http://www.sperosfinancial.com/

https://www.linkedin.com/pub/vasilios-%22voss%22-speros/60/722/67b

vsperos@sperosfinancial.com

85254

RSS Feed

RSS Feed