Speros Financial Retirement Tip of the day!

Vasilios "Voss" Speros 602-531-5141

For the year ending September 30, the cost of future lifetime retirement income has outpaced increases in retirement savings balances. That's left many pre-retirees with lower estimated retirement income despite strong market growth over the same period."

If that does not sound like a market update you've heard before, you're not alone. You're probably asking what does the cost of lifetime retirement income mean

What is retirement income? For our purposes, let's define retirement income as any method of obtaining a stream of income from a retirement account savings balance. We'll exclude other sources of retirement income not dependent on your savings, such as Social Security.

Why should income "cost" me anything? If you buy an income product, such as an annuity, you are paying a third party to assume longevity, market, interest and inflation risks on your behalf. (In other words, they are contracted to pay you for as long as you live, regardless of what the market does.) Even if you have no interest in an income product, we believe that estimating the cost of buying retirement income can help clarify your planning.

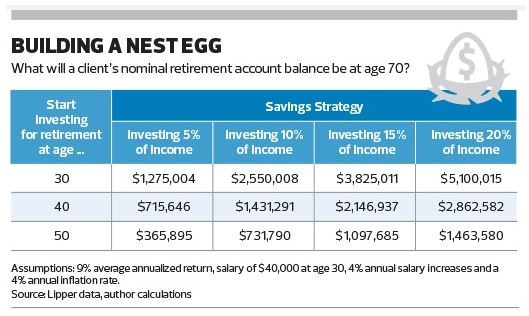

How does it help clarify my retirement planning? It gives you something to measure your retirement drawdown strategy against. For example, if your estimated retirement income is much lower than you anticipated, you may need to reexamine your plans. It can also help you estimate how much you need to save in order to obtain a certain income level.

Lessons Learned in the Q3 2014 Report So what have we learned? Perhaps the biggest takeaway for pre-retirees is that the relationship between asset growth and retirement income is far more complicated than it appears. For example, for the year ending September 30, 2014, the median retirement savings balance for a 55 year old rose 16.5%, largely due to strong market growth. At the same time, the estimated retirement income cost for a 55 year old increased from $12.76 per dollar to $15.12. The net result is they can expect less retirement income despite the asset growth.

The major driver of the increased cost of retirement income is that yields on 10-year Treasury notes fell over the year, from 2.64% to 2.52%. This change affected pre-retirees in their 60s less, who saw their market driven savings growth outpace the rise in retirement income costs, leaving them in relatively better shape than their younger peers. It is counterintuitive that your retirement savings balance can increase while your retirement spending power decreases. That is one of the reasons that by tracking retirement income costs, you can develop greater clarity in your retirement planning.

Vasilios "Voss" Speros 602-531-5141

https://www.sperosfinancial.com/

#lifeinsurance #RetirementStrategies #sperosfinancial

https://www.linkedin.com/pub/vasilios-%22voss%22-speros/60/722/67b

[email protected]

85254

RSS Feed

RSS Feed