By Steve Vernon MoneyWatch December 4, 2014, 8:27 AM

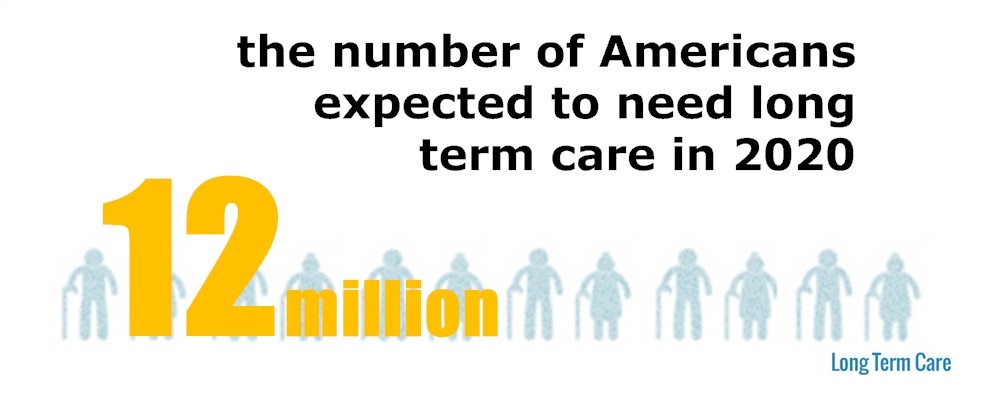

Financial risk can be notoriously hard to spot, but there is one thing people can be certain of -- we get old. So why do so few people buy long-term care insurance?

In part, it's because only about 20 to 30 percent of the U.S. population is optimally suited to benefit from such coverage, according to a recent study by Boston College's Center for Retirement Research (CRR). But there are compelling reasons to make long-term care insurance a key element in your retirement planning.

For one, long-term care is expensive. In 2012, the average annual cost for a nursing home was $81,030, and the average hourly rate for home health care was $21. Yet only about 13 percent of the population buys long-term care insurance, which could help defray these costs. In theory, if consumers were rational planners, they'd buy insurance to mitigate the risk of running through their retirement savings on care.

Long-term care is defined as assistance with the basic activities of daily living, such as dressing, eating, taking medications, showering and using the bathroom. So it isn't medical care. As a result, neither medical insurance policies nor Medicare pay for most long-term care expenses, although Medicare will pay for up to 100 days in a skilled nursing facility (SNF) following a hospital stay and some medical insurance policies cover a minimal amount of assistance.

Medicaid, on the other hand, is a program operated by the states that pays for long-term care for indigent citizens; it usually requires that an individual first draw down most of their financial assets in order to be eligible. The availability of Medicaid has been cited as one reason why people don't buy long-term care insurance.

The CRR study calculated a "willingness to pay" ratio that analyzed the percent of the population who could expect to benefit from a long-term care insurance policy to cover costs that aren't paid by Medicare or Medicaid. The CRR study took into account:

So what's the bottom line for you? Consider the possibility that you could one day face potentially ruinous long-term care expenses.

Notably, the people most vulnerable to this threat have substantial retirement savings, since they won't be eligible for Medicaid until their savings are exhausted. Women are particularly in danger, since wives tend to outlive husbands (This is illustrated by the fact that the CRR's willingness-to-pay ratio is much higher for women than for men.)

Everybody should have a strategy to address the threat of long-term care expenses, which can include some combination of the following:

With respect to this latter point, be careful! The need to provide care for elderly parents often derails the career and retirement plans of older workers, most often women, who typically reduce their hours or quit their jobs to care for an elderly relative.

Studies like the CRR analysis look for logical reasons why people should or shouldn't buy long-term care insurance.

Ultimately, the most likely reason people aren't buying such insurance is that the perceived threat of long-term care is so far in the future that it's a lot easier to ignore it. People just hope that they won't need expensive long-term care. But hope is not a strategy.

© 2014 CBS Interactive Inc.. All Rights Reserved.

Vasilios "Voss" Speros 602-531-5141

#LifeInsurance #RetirementStrategies #sperosfinancial

http://www.sperosfinancial.com/

https://www.linkedin.com/pub/vasilios-%22voss%22-speros/60/722/67b

vsperos@sperosfinancial.com

85254

By Steve Vernon MoneyWatch December 4, 2014, 8:27 AM

Financial risk can be notoriously hard to spot, but there is one thing people can be certain of -- we get old. So why do so few people buy long-term care insurance?

In part, it's because only about 20 to 30 percent of the U.S. population is optimally suited to benefit from such coverage, according to a recent study by Boston College's Center for Retirement Research (CRR). But there are compelling reasons to make long-term care insurance a key element in your retirement planning.

For one, long-term care is expensive. In 2012, the average annual cost for a nursing home was $81,030, and the average hourly rate for home health care was $21. Yet only about 13 percent of the population buys long-term care insurance, which could help defray these costs. In theory, if consumers were rational planners, they'd buy insurance to mitigate the risk of running through their retirement savings on care.

Long-term care is defined as assistance with the basic activities of daily living, such as dressing, eating, taking medications, showering and using the bathroom. So it isn't medical care. As a result, neither medical insurance policies nor Medicare pay for most long-term care expenses, although Medicare will pay for up to 100 days in a skilled nursing facility (SNF) following a hospital stay and some medical insurance policies cover a minimal amount of assistance.

Medicaid, on the other hand, is a program operated by the states that pays for long-term care for indigent citizens; it usually requires that an individual first draw down most of their financial assets in order to be eligible. The availability of Medicaid has been cited as one reason why people don't buy long-term care insurance.

The CRR study calculated a "willingness to pay" ratio that analyzed the percent of the population who could expect to benefit from a long-term care insurance policy to cover costs that aren't paid by Medicare or Medicaid. The CRR study took into account:

- The likelihood of ever needing nursing home care in a lifetime, estimated by the CRR as 44 percent of men and 58 percent of women who had attained aged 65.

- The duration of such care, estimated by the CRR as averaging 0.88 of a year for men and 1.37 of a year for women.

So what's the bottom line for you? Consider the possibility that you could one day face potentially ruinous long-term care expenses.

Notably, the people most vulnerable to this threat have substantial retirement savings, since they won't be eligible for Medicaid until their savings are exhausted. Women are particularly in danger, since wives tend to outlive husbands (This is illustrated by the fact that the CRR's willingness-to-pay ratio is much higher for women than for men.)

Everybody should have a strategy to address the threat of long-term care expenses, which can include some combination of the following:

- Hold home equity in reserve as a source that can be tapped in case long-term care is needed (which might argue against using a reverse mortgage to generate retirement income).

- Buy a long-term care insurance policy.

- Maintain a substantial investment reserve that isn't tapped to generate retirement income, or only use interest and dividends for retirement income and hold the principal in reserve for long-term care costs.

- Be aware of lower-cost alternatives to a nursing home, such as a residential care facility for the elderly.

- Be vigilant about taking care of your health to reduce the odds of eventually needing care.

- Move close to family who could potentially take care of you, but make sure they're willing and able to provide this care.

With respect to this latter point, be careful! The need to provide care for elderly parents often derails the career and retirement plans of older workers, most often women, who typically reduce their hours or quit their jobs to care for an elderly relative.

Studies like the CRR analysis look for logical reasons why people should or shouldn't buy long-term care insurance.

Ultimately, the most likely reason people aren't buying such insurance is that the perceived threat of long-term care is so far in the future that it's a lot easier to ignore it. People just hope that they won't need expensive long-term care. But hope is not a strategy.

© 2014 CBS Interactive Inc.. All Rights Reserved.

Vasilios "Voss" Speros 602-531-5141

#LifeInsurance #RetirementStrategies #sperosfinancial

http://www.sperosfinancial.com/

https://www.linkedin.com/pub/vasilios-%22voss%22-speros/60/722/67b

vsperos@sperosfinancial.com

85254

RSS Feed

RSS Feed